0001618563FALSEDEF 14A00016185632023-01-012023-12-310001618563nsa:FischerMember2023-01-012023-03-31iso4217:USD0001618563nsa:CramerMember2023-04-012023-12-31nsa:fFOPerShare0001618563nsa:FischerMember2022-01-012022-12-3100016185632022-01-012022-12-310001618563nsa:FischerMember2021-01-012021-12-3100016185632021-01-012021-12-310001618563nsa:FischerMember2020-01-012020-12-3100016185632020-01-012020-12-3100016185632023-01-012023-03-3100016185632023-04-012023-12-310001618563nsa:FischerMembernsa:NSAEquityAwardsReportedValueMemberMemberecd:PeoMember2023-01-012023-03-310001618563nsa:NSAEquityAwardsReportedValueMemberMembernsa:CramerMemberecd:PeoMember2023-04-012023-12-310001618563ecd:NonPeoNeoMembernsa:NSAEquityAwardsReportedValueMemberMember2023-01-012023-12-310001618563nsa:FischerMembernsa:NSAEquityAwardsGrantedDuringTheYearUnvestedMemberMemberecd:PeoMember2023-01-012023-03-310001618563nsa:CramerMembernsa:NSAEquityAwardsGrantedDuringTheYearUnvestedMemberMemberecd:PeoMember2023-04-012023-12-310001618563ecd:NonPeoNeoMembernsa:NSAEquityAwardsGrantedDuringTheYearUnvestedMemberMember2023-01-012023-12-310001618563nsa:FischerMembernsa:NSAEquityAwardsGrantedInPriorYearsUnvestedMemberMemberecd:PeoMember2023-01-012023-03-310001618563nsa:NSAEquityAwardsGrantedInPriorYearsUnvestedMemberMembernsa:CramerMemberecd:PeoMember2023-04-012023-12-310001618563ecd:NonPeoNeoMembernsa:NSAEquityAwardsGrantedInPriorYearsUnvestedMemberMember2023-01-012023-12-310001618563nsa:FischerMembernsa:EquityAwardsGrantedDuringTheYearVestedMemberMemberecd:PeoMember2023-01-012023-03-310001618563nsa:EquityAwardsGrantedDuringTheYearVestedMemberMembernsa:CramerMemberecd:PeoMember2023-04-012023-12-310001618563ecd:NonPeoNeoMembernsa:EquityAwardsGrantedDuringTheYearVestedMemberMember2023-01-012023-12-310001618563nsa:FischerMembernsa:NSAChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatVestedInCoveredYearMemberecd:PeoMember2023-01-012023-03-310001618563nsa:NSAChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatVestedInCoveredYearMembernsa:CramerMemberecd:PeoMember2023-04-012023-12-310001618563nsa:NSAChangeInFairValueOfEquityAwardsGrantedInPriorYearsThatVestedInCoveredYearMemberecd:NonPeoNeoMember2023-01-012023-12-310001618563nsa:FischerMembernsa:NSAFairValueAsOfPriorYearEndOfEquityAwardsGrantedInPriorYearsThatFailedToVestInCoveredYearMemberecd:PeoMember2023-01-012023-03-310001618563nsa:NSAFairValueAsOfPriorYearEndOfEquityAwardsGrantedInPriorYearsThatFailedToVestInCoveredYearMembernsa:CramerMemberecd:PeoMember2023-04-012023-12-310001618563ecd:NonPeoNeoMembernsa:NSAFairValueAsOfPriorYearEndOfEquityAwardsGrantedInPriorYearsThatFailedToVestInCoveredYearMember2023-01-012023-12-310001618563nsa:FischerMembernsa:NSADollarValueOfDividendsEarningPaidOnEquityAwardsInTheCoveredYearMemberecd:PeoMember2023-01-012023-03-310001618563nsa:NSADollarValueOfDividendsEarningPaidOnEquityAwardsInTheCoveredYearMembernsa:CramerMemberecd:PeoMember2023-04-012023-12-310001618563ecd:NonPeoNeoMembernsa:NSADollarValueOfDividendsEarningPaidOnEquityAwardsInTheCoveredYearMember2023-01-012023-12-310001618563nsa:FischerMembernsa:NSAExcessFairValueForEquityAwardModificationsMemberecd:PeoMember2023-01-012023-03-310001618563nsa:NSAExcessFairValueForEquityAwardModificationsMembernsa:CramerMemberecd:PeoMember2023-04-012023-12-310001618563ecd:NonPeoNeoMembernsa:NSAExcessFairValueForEquityAwardModificationsMember2023-01-012023-12-31000161856312023-01-012023-12-31000161856322023-01-012023-12-31000161856332023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material under §240.14a-12

National Storage Affiliates Trust

(Name of Registrant as Specified In Its Declaration of Trust)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

x No fee required.

¨ Fee paid previously with preliminary materials.

¨ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

Dear fellow shareholders:

During our nine years operating as a public company, National Storage Affiliates has maintained a commitment to growth and positive change. In 2023, that focus resulted in important achievements that we believe strategically position the Company for future success.

In 2023, we:

•Sold assets to improve our portfolio concentration in attractive markets and reduce our exposure to slower growing markets and assets;

•Utilized asset sale proceeds to reduce our floating rate debt exposure, free up our revolving line of credit and buy back common shares;

•Formed a new joint venture to access additional investment capital; and

•Invested in our data warehouse and new AI technology to enhance our operating model and drive efficiencies.

These accomplishments would not have been possible without the hard work of our over 1,000 employees and the continued partnership of our PROs. As we enter our tenth year as a public company, we are diligently focused on advancing our People, Process and Platform initiatives to drive value for our shareholders and all stakeholders.

As our business evolves, so too does our governance. In February, we welcomed a new independent trustee, Lisa Cohn, to our board of trustees, and in March, we increased the size of our board from 11 to 12 trustees and nominated Michael Schall to stand for election at our 2024 annual meeting of shareholders as an independent trustee. We have also revamped our proxy statement, making changes to organization and formatting to enhance transparency and improve readability.

We hope these changes will be helpful as you consider your vote ahead of our 2024 annual meeting of shareholders, which will be held virtually on Monday, May 13, 2024 at 11:00 a.m., mountain daylight time. We are pleased to invite you to attend that meeting and, in all events, we encourage you to have your say in our governance and direction by voting your shares.

Thank you for your continued support and investment in National Storage Affiliates.

| | | | | |

| |

Tamara D. Fischer Executive Chairperson | David G. Cramer

President, Chief Executive Officer and Trustee |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

May 13, 2024

To the Shareholders of National Storage Affiliates Trust:

We invite you to attend the 2024 annual meeting of shareholders (the "Annual Meeting") of National Storage Affiliates Trust, a Maryland real estate investment trust (the "Company," "we," "our" or "us").

| | | | | |

| Meeting Date: | May 13, 2024 |

| |

| Time: | 11:00 a.m., Mountain Daylight Time (MDT) |

| |

| Location: | The Annual Meeting will be held virtually at www.virtualshareholdermeeting.com/NSA2024. |

| |

| Record Date: | March 15, 2024 |

| |

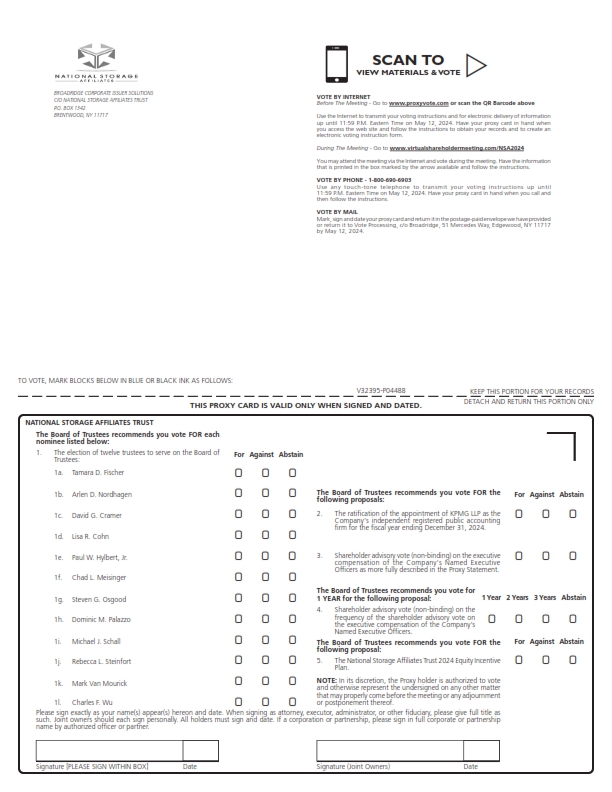

| Items of Business: | 1. Election of Twelve Trustees to the Company's Board of Trustees |

| 2. Ratification of Appointment of KPMG LLP as our Independent Registered Public Accounting Firm for 2024 |

| 3. Non-Binding Advisory Resolution to Approve Executive Compensation |

| 4. Non-Binding Advisory Resolution to Approve the Frequency of Holding an Advisory Vote on Executive Compensation |

| 5. Approval of the National Storage Affiliates Trust 2024 Equity Incentive Plan |

| 6. Transaction of Other Business that Properly Comes Before the Annual Meeting |

| Our board of trustees recommends that you vote FOR each of Items 1, 2, and 3, FOR "Every Year" for Item 4, and FOR Item 5. |

| |

| How to Vote: | This proxy statement includes information on how to vote your common shares. |

Your proxy is being solicited by our board of trustees.

We hope that all shareholders who can do so will attend the Annual Meeting in person via the live webcast. Whether or not you plan to attend, we urge you to promptly submit your proxy or voting instructions to help the Company avoid the expense of follow-up mailings and ensure the presence of a quorum at the Annual Meeting.

| | | | | |

| By Order of the Board of Trustees, |

| |

| |

| Tiffany S. Kenyon

Executive Vice President, Chief Legal Officer, and Secretary |

Greenwood Village, Colorado

March 29, 2024

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be held on May 13, 2024. The Proxy Statement, our 2023 Annual Report to Shareholders, and the means to vote electronically at the Annual Meeting or by Internet, telephone or mail are available at www.proxyvote.com. You will need to enter the control number found on your proxy card to access these materials via the Internet.

| | | | | |

NATIONAL STORAGE AFFILIATES 2024 PROXY STATEMENT | 2 |

WHO WE ARE

As summarized below, our trustees and trustee nominees have unusually deep industry-specific operating expertise as well a wide, varied, and complementary set of skills, experiences, and attributes. The information about our trustees and trustee nominees is current as of March 15, 2024. We refer to our company as the "Company," "NSA", "we," "our" or "us".

| | | | | | | | | | | |

Tamara D. Fischer Age: 68 | | EXPERIENCE |

| 2013 - Present | –Executive Chairperson of NSA since April 2023 –Prior roles at NSA include Chief Executive Officer ("CEO") (January 2020 – March 2023), President (July 2018 – June 2022), and Chief Financial Officer (2013 – December 2019) |

| 2004 -2008 | –Executive Vice President & Chief Financial Officer of Vintage Wine Trust, Inc., a triple net lease real estate investment trust ("REIT") focused on real estate assets related to the U.S. domestic wine industry |

| 1993 - 2003 | –Executive Vice President & Chief Financial Officer of Chateau Communities, Inc., one of the largest REITs in the manufactured home community sector |

| PUBLIC COMPANY AND OTHER BOARDS |

| –NSA, since 2020 –Mid-America Apartment Communities, Inc. (NYSE: MAA), since 2023 •Member of audit committee and real estate investment committee –Duke Realty Corporation (NYSE: DRE) (2020 – 2022) –JLL Income Property Trust, Inc., since 2023 –National Self Storage Association, since 2020 •Past Chairperson of the Board –Nareit Executive Board, since 2020 |

| QUALIFICATIONS AND EXPERTISE |

| –Certified public accountant (inactive) –Bachelor of arts, business administration, Case Western Reserve University –Financial expertise and extensive experience with self storage, real estate investments and the REIT industry |

.

| | | | | |

NATIONAL STORAGE AFFILIATES 2024 PROXY STATEMENT | 3 |

| | | | | | | | | | | |

Arlen D. Nordhagen Age: 67 | | EXPERIENCE |

| 2013 - Present | –Vice Chairperson of NSA since April 2023 –Founder of NSA –Prior roles at NSA include CEO (2013 - December 2019), Executive Chairman (January 2020 - March 2023), Chairman (April 2015 - December 2019), and Chairman of the Board of Managers of NSA's sole trustee (pre-April 2015) |

| 1988 - 2014 | –Co-founded SecurCare Self Storage, Inc. ("SecurCare"), one of our participating regional operators ("PROs") until March 2020 –President and CEO of SecurCare (2000 - 2014) |

| Prior Other Experience | –Founder of MMM Healthcare, Inc., the largest provider of Medicare Advantage health insurance in Puerto Rico –Managing member of various private investment funds and held various managerial positions at DuPont and Synthetech, Inc. |

| PUBLIC COMPANY AND OTHER BOARDS |

| –NSA, since 2015 |

| QUALIFICATIONS AND EXPERTISE |

| –Masters of business administration, with high distinction, Harvard University –Bachelor of science, chemical engineering, summa cum laude, University of North Dakota –Over 30 years of experience in the self storage sector; grew SecurCare to over 150 self storage properties –Extensive real estate investment, operations, financial and REIT industry expertise |

| | | | | | | | | | | |

David G. Cramer Age: 59 | | EXPERIENCE |

| 2020 - Present | –CEO of NSA since April 2023 –President of NSA since July 2022 –Prior roles at NSA include Chief Operating Officer (2020 - April 2023) |

| 1998 - 2020 | –President and CEO of SecurCare (2014 - 2020) –Prior roles at SecurCare include Chief Operating Officer and director of operations |

| Prior Other Experience | –Founding board member of FindLocalStorage.com, an industry digital marketing consortium –Served on NSA's PRO Advisory Committee and Chairperson of NSA's Technology and Best Practices Group since NSA's formation |

| PUBLIC COMPANY AND OTHER BOARDS |

| –NSA, since 2023 –SBOA TI Reinsurance Ltd., a Cayman Islands exempted company, in which we have an approximate 6% ownership interest |

| QUALIFICATIONS AND EXPERTISE |

| –Over 25 years of experience in the self storage sector –Extensive real estate investment, acquisitions, operations and digital marketing expertise |

| | | | | |

NATIONAL STORAGE AFFILIATES 2024 PROXY STATEMENT | 4 |

| | | | | | | | | | | |

Lisa R. Cohn Age: 55 | | EXPERIENCE |

| 2020 - Present | –President & General Counsel of Apartment Income REIT Corp. (NYSE: AIRC), with responsibility for governance, information technology and process innovation, human resources, and legal |

| 2002 - 2020 | –Various leadership roles with Aimco (NYSE: AIV), including most recently as Executive Vice President, General Counsel and Secretary, with responsibility for construction services, asset quality and service, insurance, risk management, human resources, property dispositions nationwide, and Aimco’s acquisition activities in the western region –Previously served as chairperson of Aimco’s investment committee |

| Prior Other Experience | –Attorney at Hogan & Hartson LLP (now Hogan Lovells), with an emphasis on public and private transactional work, public equity offerings and venture capital financing –Federal judicial clerk |

| PUBLIC COMPANY AND OTHER BOARDS |

| –NSA, since February 2024 –Nareit Advisory Board of Governors –BBYO, since 2022 –Craig Hospital Foundation, since 2018 •Chairperson of Finance and Investment Committee –Rose Community Foundation (2010 - 2020) –Denver Jewish Day School (2008 - 2016) •Chairperson of Board of Trustees (2012 - 2015) |

| QUALIFICATIONS AND EXPERTISE |

| –Juris Doctor degree, cum laude, Harvard Law School –Bachelor's degree, public policy, with honors and distinction, Stanford University –Extensive legal expertise and experience with REITs, corporate governance, business operations and strategy |

| | | | | |

NATIONAL STORAGE AFFILIATES 2024 PROXY STATEMENT | 5 |

| | | | | | | | | | | |

Paul W. Hylbert, Jr. Age: 79 | | EXPERIENCE |

| 2011 - Present | –Chairman of Kodiak Building Partners, LLC ("Kodiak"), a building products distribution platform –Prior roles at Kodiak include CEO (2011 - 2014) |

| 2007 - 2010 | –President & CEO of ProBuild Holdings, Inc., a national fabricator and distributor of building products and a subsidiary of Fidelity Capital |

| 2000 - 2006 | –President & CEO of Lanoga Corporation, one of the top U.S. retailers of lumber and building materials, until acquired by Fidelity Capital |

| 1991991 to 2000 | –President & Co-CEO of PrimeSource Building Products, a national fabricator, packager and distributor of building products (1991 - 1997), after which the company was sold and Mr. Hylbert served as President (1997 - 2000) |

| Prior Other Experience | –CEO of Wickes Europe, Wickes Lumber, and Sequoia Supply subsidiaries of Wickes, Inc. before leading a leveraged buy-out of Sequoia Supply to form PrimeSource Building Products in 1987 |

| PUBLIC COMPANY AND OTHER BOARDS |

| –NSA, since 2015 •Lead independent trustee since 2016 |

| QUALIFICATIONS AND EXPERTISE |

| –Masters of business administration, University of Michigan –Bachelor of arts, Denison University –Extensive experience in acquisitions and "roll-up" transactions –Over 40 years of experience as an officer or director of numerous companies |

| | | | | |

NATIONAL STORAGE AFFILIATES 2024 PROXY STATEMENT | 6 |

| | | | | | | | | | | |

Chad L. Meisinger Age: 56 | | EXPERIENCE |

| 2006 - Present | –Founder & CEO of Over The Top (OTT) Marketing, which provides multi-location businesses with large scale, inbound digital customer acquisition services that are delivered through a proprietary software platform |

| 2015 - 2017 | –Founder, President & CEO of IP Dynamx |

| 2011 - 2014 | –Developed more than 40 chiropractic clinics throughout Los Angeles County with regional development rights for The Joint Corp. |

| 2006 - 2009 | –Head of affiliate sales and marketing for Google Radio, which he joined after serving as a key investor and chief marketing officer of dMarc Broadcasting, which was acquired by Google Radio in 2006 for $1.2 billion in cash and performance incentives |

| 1999 - 2005 | –Co-founder, Chairman & CEO of First MediaWorks, which provided the radio industry with a proprietary software platform and marketing services to help increase ratings and revenue and which was sold to Mediaspan in 2005 |

| Prior Other Experience | –Co-founded Thinique Medical Weight Loss in 2013 and built to over 200 franchised units within a year before selling to one of his co-founders –Beginning in 1995, co-founder, CEO and board trustee of First Internet Franchise Corporation, the first Internet Service Providers (ISP) franchisor in the world with hundreds of franchise territories licensed worldwide |

| PUBLIC COMPANY AND OTHER BOARDS |

| –NSA, since 2015 |

| QUALIFICATIONS AND EXPERTISE |

| –Extensive digital marketing, technology, cybersecurity and franchising experience and strong entrepreneurial character |

| | | | | |

NATIONAL STORAGE AFFILIATES 2024 PROXY STATEMENT | 7 |

| | | | | | | | | | | |

Steven G. Osgood Age: 67 | | EXPERIENCE |

| 2008 - Present | –CEO of Square Foot Companies, LLC, a Cleveland, Ohio based private real estate company focused on single tenant properties –Adjunct Professor, Georgetown University (January 2024 - Present) |

| 2007 - 2008 | –Chief Financial Officer of DuPont Fabros Technology, Inc., a Washington, DC based REIT that owned, operated and developed data center properties, which merged with Digital Realty Trust Inc. in 2017 |

| 2006 - 2007 | –Chief Financial Officer of Global Signal, Inc., a Sarasota, Florida based REIT that was acquired by Crown Castle International Corp. in 2007 |

| 2004 - 2006 | –President & Chief Financial Officer of U-Store-It Trust (now CubeSmart), a Cleveland, Ohio based self storage REIT |

| 1993 - 2004 | –Chief Financial Officer of the Amsdell Companies, the predecessor of U-Store-It |

| Prior Other Experience | –Manager of All Stor Storage, LLC (liquidated) –Member of the audit staff of Touche Ross & Co. (1978 - 1982) |

| PUBLIC COMPANY AND OTHER BOARDS |

| –NSA, since 2015 •Chairperson of Finance Committee –Hannon Armstrong Sustainable Infrastructure Capital, Inc. (NYSE: HASI) • Chairperson of audit committee and member of compensation committee –Alzheimer's Impact Movement |

| QUALIFICATIONS AND EXPERTISE |

| –Former certified public accountant –Masters of business administration, University of San Diego –Bachelor of science, Miami University –Extensive self storage, real estate, finance, and public company expertise |

| | | | | |

NATIONAL STORAGE AFFILIATES 2024 PROXY STATEMENT | 8 |

| | | | | | | | | | | |

Dominic M. Palazzo Age: 68 | | EXPERIENCE |

| 1982 - 2011 | –Various roles at PricewaterhouseCoopers LLC ("PwC"), including most recently as audit partner •Responsible for real estate practice in Denver, Colorado office •Expertise in due diligence, mergers and acquisitions, public equity and debt offerings, corporate restructurings and financings •Clients included Chateau Communities, Affordable Residential Communities, and other private real estate companies •Served real estate clients developing different types of real estate assets, including multi-family, office, hotels and resort properties •Responsible for the initial public offering of Affordable Residential Communities in 2004 •Served in the PwC National Accounting and SEC Directorate in New York City, performing technical accounting consultations and research for PwC |

| Prior Other Experience | –Past president of the Executive Real Estate Roundtable –Former member of the Colorado Society of CPAs and the American Institute of Certified Public Accountants |

| PUBLIC COMPANY AND OTHER BOARDS |

| –NSA, since 2015 •Chairperson of Audit Committee |

| QUALIFICATIONS AND EXPERTISE |

| –Bachelor of science, accounting, DePaul University –Over 34 years of combined experience in public accounting and industry –Extensive real estate public accounting experience |

| | | | | | | | | | | |

Michael J. Schall Age: 66 | | EXPERIENCE |

| 1993 - 2023 | –President & CEO of Essex Property Trust, Inc. (2011 - 2023) –Prior roles at Essex Property Trust, Inc. include Senior Executive Vice President & Chief Operating Officer (2005 - 2010) and Chief Financial Officer (1993 - 2005) |

| Prior Other Experience | –Chief Financial Officer of Essex Property Corporation, the predecessor to Essex Property Trust, Inc. –Joined The Marcus & Millichap Company in 1986 –Director of finance for Churchill International, a technology-oriented venture capital company (1982 -1986) –Member of the audit department at Ernst & Young (then known as Ernst & Whinney), specializing in the real estate and financial services industries (1979 - 1982) |

| PUBLIC COMPANY AND OTHER BOARDS |

| –Essex Property Trust, Inc. (NYSE: ESS), since 1994 –Pebblebrook Hotel Trust, Inc. (NYSE: PEB), since 2009 •Member of compensation committee and nominating and corporate governance committee –Former member of Nareit Executive Board of Governors –Member of National Multifamily Housing Council –Member of American Institute of CPAs |

| QUALIFICATIONS AND EXPERTISE |

| –Bachelor of science, University of San Francisco –Certified public accountant (inactive) –Extensive REIT, finance, business operations and strategy expertise |

| | | | | |

NATIONAL STORAGE AFFILIATES 2024 PROXY STATEMENT | 9 |

| | | | | | | | | | | |

Rebecca L. Steinfort Age: 54 | | EXPERIENCE |

| 2018 - 2023 | –CEO of Eating Recovery Center/Pathlight Behavioral Health ("ERC"), a national healthcare services provider focused on treating patients suffering from behavioral health conditions –Prior roles at ERC include President and Chief Operating & Business Development Officer |

| 2015 - 2016 | –CEO of Hero Management LLC, a leading provider of healthcare practice management services for dental, orthodontic and vision care practices that serve the pediatric Medicaid population |

| 2009 - 2015 | –Various positions at DaVita Healthcare Partners ("DaVita"), including Co-Founder and Chief Operating Officer of DaVita's primary-care subsidiary and Chief Strategy and Marketing Officer of DaVita's dialysis business unit |

| 2007 - 2009 | –Various leadership positions at QIP Holder, LLC (parent company of Quiznos, a multinational sandwich franchise), including Chief Marketing Officer |

| 2001 - 2006 | –Various senior executive positions at Level 3 Communications, LLC |

| 1997 - 1999 | –Consultant at Bain & Company |

| PUBLIC COMPANY AND OTHER BOARDS |

| –NSA, since 2018 •Chairperson of Compensation, Nominating and Corporate Governance Committee ("CNCG Committee") –Milacron Holdings Corp. (NYSE: MCRN) (2017 - 2019) •Member of audit committee –Nature’s Sunshine Products, Inc. (NYSE: NATR) (2015 - 2018) •Chairperson of compliance committee and member of audit committee –One Call, since 2023 •Non-executive Chairperson of Board of Directors –Forefront Dermatology, since 2023 –Banyan Treatment Centers, since 2023 •Chairperson of audit committee –Helping Hands Family, since 2023 |

| QUALIFICATIONS AND EXPERTISE |

| –Masters of business administration, Harvard University –Bachelor of arts, Princeton University –Extensive marketing, technology and strategic planning expertise |

| | | | | |

NATIONAL STORAGE AFFILIATES 2024 PROXY STATEMENT | 10 |

| | | | | | | | | | | |

Mark Van Mourick Age: 67 | | EXPERIENCE |

| 2007 - Present | –Co-owner and co-founder of Optivest Properties, LLC ("Optivest"), one of our PROs |

| 1987 - 2018 | –Founder and CEO of Optivest Wealth Management, an SEC registered wealth management firm serving wealthy families in southern California |

| Prior Other Experience | –Senior Vice President and principal at Smith Barney, Harris, Upham (prior to 1987) |

| PUBLIC COMPANY AND OTHER BOARDS |

| –NSA, since 2015 –Optivest Foundation •Chairman of the board –Northrise University |

| QUALIFICATIONS AND EXPERTISE |

| –Bachelor of science, international finance and management, University of Southern California –Principal, general partner, managing member and/or agent in more than 80 real estate syndications since 1991 –Extensive real estate, self storage and financial experience |

| | | | | | | | | | | |

Charles F. Wu Age: 66 | | EXPERIENCE |

| 2015 - Present | –Executive Fellow at Harvard University’s Graduate School of Business –Prior roles at Harvard University’s Graduate School of Business include Senior Lecturer |

| 2004 - 2015 | –Co-founder and Managing Director of BayNorth Capital, a Boston-based private real estate equity firm |

| 1998 - 2004 | –Co-founder and Managing Director of Charlesbank Capital Partners, a private equity firm |

| 1995 - 1998 | –Managing Director of Harvard Private Capital Group, the private equity and real estate investment unit of Harvard Management Company and predecessor firm to Charlesbank Capital Partners |

| Prior Other Experience | –Managing Director at Aldrich Eastman & Waltch ("AEW"), where he directed the restructuring group and was a portfolio manager –Prior to AEW, worked at Morgan Stanley in their corporate finance department |

| PUBLIC COMPANY AND OTHER BOARDS |

| –NSA, since 2021 –Kennebunk Savings, a Maine mutual savings bank –Trustee for the University of Massachusetts –University of Massachusetts Building Authority Board –Past Vice-Chair of Newton-Wellesley Hospital –Was a founding board member of the Rose Kennedy Greenway Conservancy –Past President of the Newton Schools Foundation –Former member of Harvard University’s Facilities and Planning Committee |

| QUALIFICATIONS AND EXPERTISE |

| –Masters of business administration, with distinction, Harvard University –Bachelor of arts, magna cum laude and Phi Beta Kappa, Harvard University –Extensive real estate and private equity investment, capital markets, and mergers and acquisitions expertise |

| | | | | |

NATIONAL STORAGE AFFILIATES 2024 PROXY STATEMENT | 11 |

| | | | | |

NATIONAL STORAGE AFFILIATES 2024 PROXY STATEMENT | 12 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Trustee Nominee Demographics |

| Fischer | Nordhagen | Cramer | Cohn | Hylbert | Meisinger | Osgood | Palazzo | Schall | Steinfort | Van Mourick | Wu |

Age(1) | 68 | 67 | 59 | 55 | 79 | 56 | 67 | 68 | 66 | 54 | 67 | 66 |

| Average Age | 64 |

Years of Tenure(1) | 4 | 9 | 1 | 0 | 9 | 9 | 9 | 9 | 0 | 6 | 9 | 3 |

| Average Tenure | 5.7 |

| Gender Diversity | ü | | | ü | | | | | | ü | | |

| Racial or Ethnic Diversity | | | | | | | | | | | | ü |

(1) Age and tenure as of March 29, 2024.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Trustee Nominee Skills and Experience |

| Fischer | Nordhagen | Cramer | Cohn | Hylbert | Meisinger | Osgood | Palazzo | Schall | Steinfort | Van Mourick | Wu |

| Self Storage Sector | ò | ò | ò | | | | ò | | | | ò | ò |

| Public Company Experience | ò | ò | ò | ò | ò | ò | ò | ò | ò | ò | | |

| REIT | ò | ò | ò | ò | | ò | ò | ò | ò | | | |

| Real Estate Investment or Management | ò | ò | ò | ò | ò | ò | ò | ò | ò | | ò | ò |

| Private Equity or Investment | ò | ò | ò | | ò | ò | ò | | ò | ò | ò | ò |

| Business Strategy or Operations | ò | ò | ò | ò | ò | ò | ò | | ò | ò | ò | ò |

| Digital Marketing | | | ò | | | ò | | | ò | ò | | |

| Legal | | | | ò | | | | | ò | | | |

| Compliance and Regulatory | ò | ò | ò | ò | ò | ò | ò | | ò | ò | ò | ò |

| Technology and Cybersecurity | | | ò | ò | | ò | | | ò | ò | | |

| Corporate Responsibility or Sustainability | ò | ò | ò | ò | | | ò | | ò | ò | | |

| Enterprise Risk Management | ò | ò | ò | ò | ò | ò | ò | | ò | ò | | |

| Financial | ò | ò | | ò | | | ò | ò | ò | ò | | |

| Mergers and Acquisitions or Capital Markets | ò | ò | ò | ò | ò | ò | ò | ò | ò | ò | ò | ò |

| | | | | |

NATIONAL STORAGE AFFILIATES 2024 PROXY STATEMENT | 13 |

PROPOSAL 1 FOR ELECTION OF TRUSTEES

PROPOSAL 1: ELECTION OF TRUSTEES

As of the date of this Proxy Statement, we have not received notice of any additional candidates to be nominated for election as trustees at the Annual Meeting. Consequently, we expect the election of trustees will be an uncontested election and the provisions of our Third Amended and Restated Bylaws (the "Bylaws") providing for majority voting in uncontested elections will apply. As a result, to be elected as a trustee, a nominee must receive votes "FOR" his or her election constituting a majority of the total votes cast for and against such nominee at the Annual Meeting at which a quorum is present. If a nominee does not receive sufficient "FOR" votes to be elected or re-elected, our board of trustees and CNCG Committee must comply with certain procedures, which are described below under "–How We Govern and Are Governed–Majority Vote and Trustee Resignation Policy". Proxies solicited by our board of trustees will be voted FOR Messrs. Nordhagen, Cramer, Hylbert, Meisinger, Osgood, Palazzo, Schall, Van Mourick, and Wu and Mss. Fischer, Cohn and Steinfort, unless otherwise instructed. Abstentions and broker non-votes will not be counted as votes cast and will have no effect on the result of the vote, although they will be considered present for the purpose of determining the presence of a quorum.

In accordance with our declaration of trust (the "Declaration of Trust") and our Bylaws, any vacancies occurring on our board of trustees, including vacancies occurring as a result of the death, resignation, or removal of a trustee, or due to an increase in the size of the board of trustees, may be filled only by the affirmative vote of a majority of the remaining trustees in office, even if the remaining trustees do not constitute a quorum, and any trustee elected to fill a vacancy will serve for the remainder of the full term of the trusteeship in which the vacancy occurred and until a successor is duly elected and qualifies.

There is no familial relationship, as defined under Securities and Exchange Commission (the "SEC") regulations, among any of the trustees, our named executive officers ("NEOs") or other executive officers, other than with respect to Mr. Cramer, who is our president, CEO and one of our trustees and a trustee nominee for re-election, and Mr. Nordhagen, our vice chairperson of the board of trustees and a trustee nominee for re-election. Messrs. Nordhagen and Cramer are brothers-in-law. See "–How We Govern and Are Governed–Trustee Independence."

Our board of trustees recommends a vote FOR the election of Messrs. Nordhagen, Cramer, Hylbert, Meisinger, Osgood, Palazzo, Schall, Van Mourick, and Wu and Mss. Fischer, Cohn and Steinfort as trustees.

HOW WE ARE SELECTED, ELECTED AND EVALUATED

SIZE OF BOARD; CURRENT NOMINEES

Our board of trustees is currently comprised of eleven trustees. In February 2024, upon the recommendation of our CNCG Committee, our board of trustees increased the size of our board from ten trustees to eleven trustees and elected Lisa R. Cohn as a trustee. In March 2024, upon the recommendation of our CNCG Committee, our board of trustees increased the size of our board from eleven trustees to twelve trustees and nominated Michael J. Schall, along with our other current trustees, to stand for election or re-election, as the case may be, at the Annual Meeting. As a result, the trustee nominees standing for election or re-election, as the case may be, at the Annual Meeting are listed below.

| | | | | |

NATIONAL STORAGE AFFILIATES 2024 PROXY STATEMENT | 14 |

| | | | | |

| Tamara D. Fischer | Steven G. Osgood |

| Arlen D. Nordhagen | Dominic M. Palazzo |

| David G. Cramer | Michael J. Schall |

| Lisa R. Cohn | Rebecca L. Steinfort |

| Paul W. Hylbert, Jr. | Mark Van Mourick |

Chad L. Meisinger | Charles F. Wu |

Each trustee elected will hold office until our next annual meeting of shareholders and until a successor has been duly elected and qualifies, or until the trustee's earlier resignation, death or removal.

INCLUSIVE TRUSTEE SELECTION PRACTICES

We seek highly qualified trustee candidates from diverse business, professional and educational backgrounds who combine a broad spectrum of experience and expertise with a reputation for the highest personal and professional ethics, integrity and values. The CNCG Committee considers diversity of all types in choosing the most qualified candidates, including gender, race/ethnicity, age, experience, orientation, veteran status and skills.

The procedures and considerations of the CNCG Committee in recommending qualified trustee candidates are described below under "–Identification of Trustee Candidates." The CNCG Committee and our board of trustees concluded that each of our trustee nominees should be nominated for election based on the qualifications and experience described in their biographical information.

It is intended that our common shares of beneficial interest (the "Common Shares") represented by properly submitted proxies will be voted by the persons named therein as proxy holders FOR the election of Messrs. Nordhagen, Cramer, Hylbert, Meisinger, Osgood, Palazzo, Schall, Van Mourick, and Wu and Mss. Fischer, Cohn and Steinfort as trustees, unless otherwise instructed. If the candidacy of any trustee nominee should, for any reason, be withdrawn prior to the Annual Meeting, the proxies will be voted by the proxy holders in favor of such substituted candidates (if any) as shall be nominated by our board of trustees. Our board of trustees has no reason to believe that, if elected, any of the nominees will be unable or unwilling to serve as a trustee.

IDENTIFICATION OF TRUSTEE CANDIDATES

In accordance with our Corporate Governance Guidelines ("Guidelines") and the CNCG Committee's written charter, the CNCG Committee is responsible for identifying and recommending trustee candidates to our board of trustees for consideration as nominees to stand for election at our annual meetings of shareholders.

The CNCG Committee evaluates the skill sets required for service on our board of trustees and periodically identifies potential trustee candidates. If it is determined there is the need for additional or replacement trustees, the CNCG Committee will assess potential trustee candidates previously identified as well as other appropriate potential trustee candidates based upon information it receives regarding such potential candidates or otherwise possesses, which assessment may be supplemented by additional inquiries. The CNCG Committee also evaluates, among other things, each potential trustee's knowledge of and experience in or with the self storage sector, REITs and other real estate investment and management businesses, private equity and other investments, finance, capital markets and mergers and acquisitions, technology and cybersecurity, digital marketing, public company experience, business strategy and operations, legal matters, compliance and regulatory matters, enterprise risk management, and corporate responsibility and sustainability matters. The CNCG Committee may seek input on such trustee candidates from other trustees, including our executive chairperson, vice chairperson and our president and CEO, and recommends trustee candidates to our board of trustees for nomination.

The CNCG Committee does not solicit trustee nominations, but it will consider recommendations by shareholders with respect to elections to be held at an annual meeting, so long as such recommendations are sent within a reasonable period of time prior to the decision. The CNCG Committee will evaluate nominees recommended by shareholders against the same criteria that it uses to evaluate other nominees. The CNCG

| | | | | |

NATIONAL STORAGE AFFILIATES 2024 PROXY STATEMENT | 15 |

Committee may, in its sole discretion, engage one or more search firms or other consultants, experts or professionals to assist in, among other things, identifying trustee candidates or gathering information regarding the background and experience of trustee candidates. If the CNCG Committee engages any such third party, the CNCG Committee will have sole authority to approve any fees or terms of retention relating to these services.

HOW WE GOVERN AND ARE GOVERNED

BOARD OF TRUSTEES

Our board of trustees is responsible for overseeing our affairs. Our board of trustees conducts its business through meetings and actions taken by written consent in lieu of meetings. Our board of trustees intends to hold at least four regularly scheduled meetings per year and additional special meetings as necessary. During 2023, our board of trustees held nine meetings. All of our trustees attended at least 75% of the meetings of our board of trustees and of the Audit Committee, CNCG Committee, and Finance Committee, on which they served during this period. Our board of trustees' policy, as set forth in our Guidelines, is to encourage and promote the attendance by each trustee at all scheduled meetings of our board of trustees and all meetings of our shareholders.

TRUSTEE INDEPENDENCE

The Guidelines provide that a majority of the trustees serving on our board of trustees must be independent as required by the New York Stock Exchange ("NYSE") listing standards. Our board of trustees has also adopted certain independence standards (the "Independence Standards") to assist it in making determinations with respect to the independence of trustees. The Independence Standards are available for viewing on our website at www.nationalstorageaffiliates.com. Based upon its review of all relevant facts and circumstances, our board of trustees affirmatively determined in 2023 that Paul W. Hylbert, Jr., Chad L. Meisinger, Steven G. Osgood, Dominic M. Palazzo, Rebecca L. Steinfort, Mark Van Mourick, and Charles F. Wu qualified as independent trustees as required by the NYSE listing standards, SEC rules, and our Guidelines and Independence Standards. Our board of trustees conducted a similar review in 2024 and determined that each of our non-executive trustee nominees, Lisa R. Cohn, Paul W. Hylbert, Jr., Chad L. Meisinger, Steven G. Osgood, Dominic M. Palazzo, Michael J. Schall, Rebecca L. Steinfort, Mark Van Mourick, and Charles F. Wu, qualified as independent trustees as required by the NYSE listing standards, SEC rules, and our Guidelines and Independence Standards. In making these determinations, the board of trustees considered the relationships and transactions described below under "Certain Relationships and Related Transactions."

LEADERSHIP STRUCTURE OF THE BOARD OF TRUSTEES

Leadership of our board of trustees is vested in our executive chairperson of the board and in our lead independent trustee. We do not have a formal policy regarding whether the roles of chairperson of the board and CEO should be separated. Rather, the CNCG Committee and the board of trustees make this determination based on relevant facts and circumstances to establish a structure that meets our needs at that time, enhances the understanding and communication between management and the board of trustees, allows for better understanding and evaluation of our operations, and improves the board of trustees' ability to perform its oversight role. Currently, we have separated the roles of chairperson of the board and CEO. Ms. Fischer serves as executive chairperson of the board, Mr. Nordhagen serves as vice chairperson, and Mr. Cramer serves as CEO (in addition to his role as president) and is a member of the board of trustees. In connection with establishing this structure, the CNCG Committee and the board of trustees determined that the separation of the roles, together with Ms. Fischer's, Mr. Nordhagen's, and Mr. Cramer's service on our board of trustees, meets our Company's needs and the above goals.

In recognition of the importance of the board of trustees' independent oversight role and the need to maintain a strong independence from management, we require our board of trustees to annually elect one independent trustee to serve as lead independent trustee when the chairperson of the board is not independent. In

| | | | | |

NATIONAL STORAGE AFFILIATES 2024 PROXY STATEMENT | 16 |

2023 and, subject to his re-election at the Annual Meeting, in 2024, our board of trustees re-appointed Paul W. Hylbert, Jr. as lead independent trustee, a role he has served in since 2016. Our lead independent trustee works with Ms. Fischer, executive chairperson of our board of trustees, Mr. Nordhagen, vice chairperson of our board of trustees, and Mr. Cramer, our president and CEO and a member of our board of trustees, to establish the agenda for regular meetings of our board of trustees. Mr. Hylbert also serves as chair of regular meetings of our board of trustees when our executive chairperson is absent, presides at executive sessions, serves as a liaison among our executive chairperson, our CEO, and our independent trustees, and encourages dialogue between our independent trustees and NEOs. He also establishes the agenda for meetings of our independent trustees and performs such other duties as our board of trustees may establish or delegate. Mr. Hylbert's experience and leadership has enhanced the operation of our board of trustees and its ability to perform its oversight role.

COMMITTEES OF THE BOARD OF TRUSTEES

Our board of trustees has three standing committees: the Audit Committee, the CNCG Committee and the Finance Committee. Set forth below is a summary of the committee roles and responsibilities, as well as the proposed composition of each committee in 2024 following the Annual Meeting, subject to the election of all of our trustee nominees.

| | | | | |

| AUDIT COMMITTEE |

| Members: | Dominic M. Palazzo (Chairperson) Steven G. Osgood Mark Van Mourick

Subject to his election at the Annual Meeting, Mr. Schall is expected to join the Audit Committee. |

Number of Meetings in 2023: | 7 |

| Independence and Financial Experts: | Each Audit Committee member is independent as required by NYSE listing standards, SEC rules, our Guidelines and Independence Standards, and our Audit Committee charter.

Our board of trustees has also determined that all of the Audit Committee members are financially literate, with the requisite accounting or related financial management expertise required by NYSE listing standards, and that Mr. Palazzo, Mr. Osgood and Mr. Schall qualify and serve as "audit committee financial experts" for purposes of, and as defined by, the SEC rules. |

| Roles and Responsibilities: | The Audit Committee's responsibilities are set forth in its written charter and include: –Engaging, reviewing the plans and results of the engagement with, and approving the services provided by, our independent registered public accounting firm; –Reviewing the independence of the independent registered public accounting firm and considering the range of audit and non-audit fees; –Reviewing the adequacy of our internal accounting controls; –Approving, after reviewing with management and external auditors, our quarterly earnings releases and supplemental financial information and our interim and audited annual financial statements prior to each filing of our quarterly reports on Form 10-Q and annual reports on Form 10-K; |

| | | | | |

NATIONAL STORAGE AFFILIATES 2024 PROXY STATEMENT | 17 |

| | | | | |

| AUDIT COMMITTEE |

| Roles and Responsibilities (continued): | –Meeting with officers responsible for certifying our annual reports on Form 10-K or any quarterly report on Form 10-Q prior to any such certification; –Reviewing with such responsible officers disclosures related to any significant deficiencies in the design or operation of internal controls; and –Periodically discussing with our external auditors such auditors' judgments about the quality, not just the acceptability, of our accounting principles as applied in our consolidated financial statements. |

| The Audit Committee also works to discharge our board of trustees' responsibilities relating to: –Our and our subsidiaries' corporate accounting and reporting practices; –The quality and integrity of our consolidated financial statements; –Our compliance with applicable legal and regulatory requirements; –The performance, qualifications and independence of our external auditors; –The staffing, performance, budget, responsibilities and qualifications of our internal audit function; and –Reviewing our policies with respect to risk assessment and risk management, including the guidelines and policies by which these activities are undertaken, the adequacy of our insurance coverage, our interest rate risk management, our counterparty and credit risks, our capital availability and refinancing risks, and any cybersecurity or environmental risks, if applicable. |

| Audit Committee Charter: | Available on our website at www.nationalstorageaffiliates.com |

| | | | | |

| COMPENSATION, NOMINATING AND CORPORATE GOVERNANCE COMMITTEE |

| Members: | Rebecca L. Steinfort (Chairperson) Paul W. Hylbert, Jr. Chad L. Meisinger

Subject to her election at the Annual Meeting, Ms. Cohn is expected to join the CNCG Committee in place of Mr. Hylbert. |

Number of Meetings in 2023: | 4 |

| Independence: | Each CNCG Committee member is independent as required by NYSE listing standards, SEC rules, our Guidelines and Independence Standards, and our CNCG Committee charter. |

| | | | | |

NATIONAL STORAGE AFFILIATES 2024 PROXY STATEMENT | 18 |

| | | | | |

| COMPENSATION, NOMINATING AND CORPORATE GOVERNANCE COMMITTEE |

| Roles and Responsibilities: | The CNCG Committee's responsibilities are set forth in its charter and include:

–Annually reviewing and approving the corporate goals and objectives relevant to the compensation paid by us to our NEOs; –Evaluating our NEOs' performance in light of such goals and objectives and, either as a committee or together with our independent trustees (as directed by the board of trustees), determining and approving the compensation of our NEOs based on that evaluation; –Overseeing our equity-based compensation plans and programs; –Reviewing and recommending to our board of trustees from time to time the compensation for our non-executive trustees; –Advising our board of trustees with respect to the organization, function and composition of the board of trustees and its committees; –Overseeing the self-evaluation of our board of trustees (individually and as a whole) and the board of trustees' evaluation of management and reporting thereon to the board of trustees; –Periodically reviewing and, if appropriate, recommending to our board of trustees changes to, our corporate governance policies and procedures; –Identifying and recommending to our board of trustees potential candidates for nomination; –Recommending to our board of trustees the appointment of our executive officers; –Assisting our executive and vice chairpersons and board of trustees in overseeing the development of executive succession plans; and –Preparing CNCG Committee reports. |

| A committee of our senior leaders oversees our physical, social and other policy risks and opportunities, including environmental, health and safety, corporate social responsibility, corporate governance, sustainability and other public policy matters that may be relevant to us ("Corporate Responsibility Committee"). The Corporate Responsibility Committee reports to, and is overseen by, our CNCG Committee and assists our board of trustees, the CNCG Committee and the Company's management in setting the Company's strategy relating to, identifying and making recommendations regarding, and overseeing communications with respect to, these matters. The chairperson(s) and other members of the Corporate Responsibility Committee provide periodic reports to the CNCG Committee.

The CNCG Committee retained Ferguson Partners Consulting, L.P. ("FPC"), a professional services firm focused on compensation and other consulting services as well as executive and board recruitment, to provide advice regarding the compensation program for our NEOs and independent trustees. FPC reports directly to the CNCG Committee on these matters. Except for the services described above, board recruitment consulting services, equity incentive plan review services, and proxy review services, FPC did not perform in 2023, and does not currently provide, any other services to management or us. |

| CNCG Committee Charter: | Available on our website at www.nationalstorageaffiliates.com |

| | | | | |

NATIONAL STORAGE AFFILIATES 2024 PROXY STATEMENT | 19 |

| | | | | |

| FINANCE COMMITTEE |

| Members: | Steven G. Osgood (Chairperson) Paul W. Hylbert, Jr. Charles F. Wu

Subject to his election at the Annual Meeting, Mr. Schall is expected to join the Finance Committee in place of Mr. Hylbert. |

Number of Meetings in 2023: | 5 |

| Independence: | Each Finance Committee member is independent as defined by our Independence Standards and as required by our Guidelines and Finance Committee charter. |

| Roles and Responsibilities: | The Finance Committee is responsible for reviewing and, where appropriate, approving, on behalf of the Company, acquisitions or dispositions of self storage properties and debt financing transactions, in each case within certain parameters. The Finance Committee is also responsible for the review and approval of the Company's hedging and swap policy and strategies. Finance Committee meetings are designed to provide the members of the Finance Committee with an opportunity to discuss the rationale for certain acquisitions or dispositions as well as certain debt financing transactions. In making any determination, the Finance Committee reviews all material background items and conducts any further due diligence necessary or desirable to make an informed decision with respect to such transactions. |

From time to time, we may form special committees of the board of trustees for a specified purpose.

REPORT OF THE AUDIT COMMITTEE

The Audit Committee has furnished the following report for the fiscal year ending December 31, 2023:

The Audit Committee is responsible for monitoring the integrity of our consolidated financial statements, our system of internal controls, our risk management, the qualifications, independence and performance of our independent registered public accounting firm and our compliance with related legal and regulatory requirements. The Audit Committee has the sole authority and responsibility to select, determine the compensation of, evaluate and, when appropriate, replace our independent registered public accounting firm. The Audit Committee operates under a written charter adopted by our board of trustees.

Management is primarily responsible for our financial reporting process including the system of internal controls and for the preparation of consolidated financial statements in accordance with accounting principles generally accepted in the United States. KPMG LLP, our independent registered public accounting firm, is responsible for performing an independent audit of our annual consolidated financial statements and expressing an opinion as to their conformity with accounting principles generally accepted in the United States and on the effectiveness of the Company’s internal controls over financial reporting based on criteria established in 2013 by the Committee of Sponsoring Organizations of the Treadway Commission. The Audit Committee’s responsibility is to oversee and review the financial reporting process. The Audit Committee is not, however, professionally engaged in the practice of accounting or auditing and does not provide any expert or other special assurance as to such financial statements concerning compliance with laws, regulations or accounting principles generally accepted in the United States or as to auditor independence. The Audit Committee relies, without independent verification, on the information provided to it and on the representations made by our management and our independent registered public accounting firm.

| | | | | |

NATIONAL STORAGE AFFILIATES 2024 PROXY STATEMENT | 20 |

The Audit Committee held seven meetings in 2023. Representatives of KPMG LLP were in attendance at six of our Audit Committee meetings. These meetings were designed, among other things, to facilitate and encourage communication among the Audit Committee, management and KPMG LLP. At these meetings, among other things, the Audit Committee reviewed and discussed with management the consolidated financial statements contained in our quarterly and annual periodic reports, as applicable, as well as our earnings releases. The Audit Committee also discussed with KPMG LLP matters that independent accounting firms must discuss with audit committees under generally accepted auditing standards and standards of the Public Company Accounting Oversight Board (“PCAOB”) and the Securities and Exchange Commission, including, among other things, matters related to the conduct of the audit of our consolidated financial statements and the matters required to be discussed by Auditing Standard No. 1301: Communications with Audit Committees, which included a discussion of KPMG LLP’s judgments about the quality (not just the acceptability) of our accounting principles as applied to financial reporting. The Audit Committee met with KPMG LLP, with and without management present, to discuss the results of their audits.

The Audit Committee also discussed with KPMG LLP their independence from us. KPMG LLP provided to the Audit Committee the written disclosures and the letter required by applicable requirements of the PCAOB regarding the independent accountant’s communication with audit committees concerning independence and represented that it is independent from us. The Audit Committee also received regular updates on the amount of fees and scope of audit and tax services provided by KPMG LLP.

Based on the Audit Committee’s review and these meetings, discussions and reports, and subject to the limitations on the Audit Committee’s role and responsibilities referred to above and in its written charter, the Audit Committee unanimously recommended to our board of trustees that our audited consolidated financial statements for the fiscal year ended December 31, 2023 be included in our annual report to shareholders and in our Annual Report on Form 10-K filed with the SEC.

Dominic M. Palazzo

Steven G. Osgood

Mark Van Mourick

The foregoing Report of the Audit Committee shall not be deemed under the Securities Act of 1933, as amended (the "Securities Act"), or the Securities Exchange Act of 1934, as amended (the "Exchange Act"), to be (i) "soliciting material" or "filed" or (ii) incorporated by reference by any general statement into any filing made by us with the SEC, except to the extent that we specifically incorporate such report by reference.

ROLE OF THE BOARD OF TRUSTEES AND RISK OVERSIGHT

Pursuant to our Declaration of Trust and Bylaws, our business and affairs are managed under the direction of our board of trustees. Our board of trustees has the responsibility for establishing broad corporate policies and for our overall performance and direction, but is not involved in our day-to-day operations. Members of our board of trustees keep informed of our business by participating in meetings of our board of trustees and its committees, by reviewing analyses, reports and other materials provided to them and through discussions with Ms. Fischer, our executive chairperson, Mr. Nordhagen, our vice chairperson, Mr. Cramer, our president, CEO, and a member of our board of trustees, and our other NEOs.

In connection with their oversight of risk to our business, our board of trustees, the Audit Committee, the Finance Committee and CNCG Committee consider feedback from management concerning the risks related to our business, operations and strategies. The Audit Committee discusses and reviews policies with respect to our risk assessment and risk management, including guidelines and policies to govern the process by which risk assessment and risk management is undertaken, the adequacy of our insurance coverage, our interest rate risk management, our counterparty and credit risks, our capital availability and refinancing risks, and any cybersecurity or environmental risks, if applicable. The Audit Committee also considers enterprise risk management, and management regularly reports to the Audit Committee and our board of trustees regarding our risk assessment and risk mitigation activities.

| | | | | |

NATIONAL STORAGE AFFILIATES 2024 PROXY STATEMENT | 21 |

The Finance Committee discusses and reviews our hedging and swap policy and strategy. The CNCG Committee discusses and reviews our human capital risk management strategies. Management also regularly reports to our board of trustees and its committees on our leverage policies, our asset acquisition process, any asset impairments and our compliance with applicable REIT rules and other regulations. Members of our board of trustees routinely meet with management and, when appropriate, outside advisors, in connection with their consideration of matters submitted for the approval of our board of trustees and the risks associated with such matters.

With respect to cybersecurity, our risk management committee established a cybersecurity subcommittee that is comprised of members of our management team and other personnel and which is focused on cybersecurity initiatives. The cybersecurity subcommittee reports regularly to our risk management committee which is composed of a cross section of the Company's management team, and the risk management committee periodically reports to the Audit Committee and board of trustees regarding the Company's cybersecurity risks and initiatives. We have also implemented cybersecurity training at all levels of our organization and conduct periodic phishing assessments for our employees to reinforce that training.

Our board of trustees believes that its composition protects shareholder interests and provides appropriate independent oversight of management. Nine of our twelve trustee nominees are "independent" as defined by NYSE listing standards, SEC rules, and our Guidelines and Independence Standards, as more fully described above under "–Trustee Independence." The independent trustees meet separately from management on at least a quarterly basis in executive sessions presided over by our lead independent trustee and are very active in the oversight of our Company. The independent trustees oversee such critical matters as the integrity of our financial statements, the evaluation and compensation of our NEOs and the selection and evaluation of trustees. Each independent trustee has the ability to add items to the agenda of board of trustees meetings or raise subjects for discussion that are not on the agenda for that meeting.

Our board of trustees believes that its supermajority independent composition and the roles that our independent trustees perform provide effective corporate governance at the board of trustees' level and independent oversight of both our board of trustees and management. The current governance structure, when combined with the functioning of the independent trustee component of our board of trustees, strikes an appropriate balance between strong and consistent leadership and independent oversight of our business and affairs.

CODE OF BUSINESS CONDUCT AND ETHICS

Our board of trustees has adopted a Code of Business Conduct and Ethics (the "Code of Conduct") that applies to our trustees, officers and employees. Among other matters, the Code of Conduct is designed to deter wrongdoing and to promote honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; full, fair, accurate, timely and understandable disclosure in our SEC reports and other public communications; compliance with applicable governmental laws, rules and regulations; prompt internal reporting of violations of the Code of Conduct to appropriate persons identified in the code; and accountability for adherence to the Code of Conduct. Any waiver of the Code of Conduct for our trustees or officers may be made only by our board of trustees or our CNCG Committee and will be promptly disclosed as required by law or stock exchange regulations. The Code of Conduct is available for viewing on our website at www.nationalstorageaffiliates.com. We will also provide the Code of Conduct, free of charge, to shareholders who request it. Requests should be directed to our corporate secretary at National Storage Affiliates Trust, 8400 East Prentice Avenue, 9th Floor, Greenwood Village, CO 80111.

PERSONAL LOANS TO EXECUTIVE OFFICERS AND TRUSTEES

We comply with, and operate in a manner consistent with, applicable law prohibiting extensions of credit in the form of personal loans to or for the benefit of our trustees and executive officers.

CORPORATE GOVERNANCE GUIDELINES

Our board of trustees has adopted Corporate Governance Guidelines that address significant issues of corporate governance and set forth procedures by which our board of trustees carries out its responsibilities,

| | | | | |

NATIONAL STORAGE AFFILIATES 2024 PROXY STATEMENT | 22 |

including the trustee resignation policy as described under "–Majority Vote and Trustee Resignation Policy" below. In addition, among the areas addressed by the Guidelines are the composition of our board of trustees, its functions and responsibilities, its standing committees, its PRO advisory committee, trustee qualification standards, access to management and independent advisors, trustee compensation, management succession, trustee orientation and continuing education, oversight of corporate responsibility initiatives, and the annual performance evaluation and review of our board of trustees and committees. The Guidelines are available for viewing on our website at www.nationalstorageaffiliates.com. We will also provide the Guidelines, free of charge, to shareholders who request it. Requests should be directed to our corporate secretary at National Storage Affiliates Trust, 8400 East Prentice Avenue, 9th Floor, Greenwood Village, CO 80111.

GOVERNANCE HIGHLIGHTS

| | | | | | | | | | | |

| ü | 9 of 12 trustee nominees are independent | ü | Equity holders may amend bylaws |

| ü | Separate chair and CEO roles | ü | Majority voting in uncontested elections |

| ü | Experienced and dedicated lead independent trustee | ü | Minimum equity ownership guidelines |

| ü | No staggered board of trustees; annual election of all trustees | ü | Active shareholder outreach program |

| ü | Diversity of age, race, gender, tenure, skills and experience among trustees | ü | No poison pill |

| ü | Recovery policy for erroneously awarded executive incentive compensation | ü | Prohibition against hedging the value of Company securities |

| ü | Three trustee nominee Audit Committee financial experts | ü | Limitations on pledging of Company securities by NEOs and trustees |

ü

| No excise tax gross-ups on payments made in connection with a change of control | ü

| Opted out of Maryland's unsolicited takeover act (which we may not opt into without shareholder approval) and control share acquisition statute |

|

As a result of our opting out of Maryland's unsolicited takeover statute, we may not stagger the election of our trustees without shareholder approval.

TRUSTEE ATTENDANCE AT ANNUAL MEETINGS OF SHAREHOLDERS

Our policy is to encourage and promote the attendance by each trustee at all meetings of our shareholders. All of our then-current trustees attended the 2023 Annual Meeting. We currently believe that all of our trustees intend to attend the upcoming Annual Meeting.

EXECUTIVE SESSIONS OF INDEPENDENT TRUSTEES

The independent trustees meet in executive sessions at least four times per year at regularly scheduled meetings of our board of trustees.

MAJORITY VOTE AND TRUSTEE RESIGNATION POLICY

We have a majority voting policy for the election of trustees in uncontested elections. Under majority voting, to be elected as a trustee in an uncontested election, a nominee must receive votes “FOR” the nominee's election constituting a majority of the total votes cast for and against such nominee at the annual meeting at which a quorum is present. If an incumbent trustee does not receive sufficient “FOR” votes to be re-elected, Maryland law provides that the incumbent trustee would continue to serve on the Company’s board of trustees as a “holdover” trustee. Under the Company’s Guidelines, the trustee must submit a letter of resignation to the Company’s board of trustees. The Company’s CNCG Committee will consider such tendered resignation and recommend to the Company’s board of trustees whether to accept it. The Company’s board of trustees will decide whether to accept

| | | | | |

NATIONAL STORAGE AFFILIATES 2024 PROXY STATEMENT | 23 |

any such resignation within 90 days after certification of the election results and will publicly disclose its decision. If the resignation is not accepted, the trustee will continue to serve until the trustee's successor is duly elected and qualifies or until the trustee’s earlier death, resignation, retirement or removal. If a trustee’s offer to resign is accepted by the Company’s board of trustees, or if a nominee for trustee is not elected and the nominee is not an incumbent trustee, then the Company’s board of trustees, in its sole discretion, may fill any resulting vacancy pursuant to the Bylaws. In a contested election, trustees shall be elected by a plurality of all the votes cast at a meeting of shareholders duly called and at which a quorum is present.

BYLAW AMENDMENTS

We have a policy to permit equity holders to alter or repeal any provision of the Bylaws and to adopt new Bylaws. Approval of amendments to the Bylaws by equity holders requires the affirmative vote of both:

•holders of a majority of the Company's Common Shares outstanding as of the Determination Date (as defined below); and

•holders of Common Shares and limited partners (other than the Company) of our operating partnership, NSA OP, LP (our "operating partnership"), representing a majority of the number of Common Shares outstanding as of the Determination Date together with the number of additional Common Shares that would be issuable if:

◦all Class A common units of limited partner interest ("OP units") in our operating partnership outstanding as of the Determination Date were exchanged on a one-for-one basis, subject to adjustments as provided in the Third Amended and Restated Agreement of Limited Partnership of our operating partnership (as amended, the "Partnership Agreement"), for Common Shares, and

◦the OP units which would be outstanding if each series of subordinated performance units (or other similar class or series of OP units created from time to time) outstanding as of the Determination Date (whether or not then convertible) were converted into OP units using the conversion ratio for each such class or series in effect as of the last day of the most recent fiscal year determined pursuant to the terms of the Partnership Agreement and as approved by the Company's board of trustees, were exchanged on a one-for-one basis, subject to adjustments as provided in the Partnership Agreement, for Common Shares.

“Determination Date” means the close of business on the record date for determining the shareholders and holders of OP units and subordinated performance units entitled to cast votes at a duly called annual or special meeting of shareholders.

Our shareholders do not have the power to alter or repeal any provision of our Bylaws relating to the amendment of our Bylaws.

HOW WE LISTEN AND COMMUNICATE

Our board of trustees values input from our investors and casts a wide net for ideas and information that can inform its deliberations and decision making. We have created multiple means to communicate with our trustees, including the following:

•Participating in our Annual Meeting and asking questions.

•Emailing us at NSABoard@nsareit.net.

| | | | | |

NATIONAL STORAGE AFFILIATES 2024 PROXY STATEMENT | 24 |

•Writing to us by regular mail, sent to the attention of David G. Cramer, our president, CEO and member of our board of trustees, at National Storage Affiliates Trust, 8400 East Prentice Avenue, 9th Floor, Greenwood Village, CO 80111.

•Making a good faith report to the Audit Committee regarding any questionable or unethical accounting or auditing matters via regular mail addressed to the Audit Committee, National Storage Affiliates Trust, 8400 East Prentice Avenue, 9th Floor, Greenwood Village, CO 80111.

•Requesting or participating in engagement meetings with our management or trustees. During 2023, we held approximately 74 of such meetings with approximately 188 current and prospective investors to discuss various key corporate matters, including our differentiated growth strategy, financing strategy, risk management practices, corporate responsibility initiatives, and strong corporate governance practices.

•Participating in other events we attend or speak at.

•Encouraging members of our board of trustees to be available to speak to institutional shareholders outside of formal meeting settings.

We reserve the right to disregard any communication we determine is unduly hostile, threatening, illegal, does not reasonably relate to us or our business, or is similarly inappropriate or that involve sales, business, or job-seeking calls.

HOW WE ARE PAID

Independent members of our board of trustees are compensated for their services as described below. Annually, each independent trustee may elect to receive between 50% and 100% of the value of their total annual cash compensation in equity. Non-independent members of our board of trustees receive no compensation for their services as trustees.

For 2023, each of our independent trustees was eligible to receive annual compensation as follows:

•Cash compensation: $60,000

•Equity compensation: $100,000

•Additional annual cash compensation:

◦Lead Independent Trustee: $25,000

◦Audit Committee:

▪Chairperson: $25,000

▪Member: $10,000

◦CNCG Committee:

▪Chairperson: $25,000

▪Member: $10,000

◦Finance Committee:

▪Chairperson: $20,000

▪Member: $10,000

| | |

For 2023, 100% of our independent trustees elected to receive some or all of their annual cash compensation in the form of equity |

| | | | | |

NATIONAL STORAGE AFFILIATES 2024 PROXY STATEMENT | 25 |

We also reimburse each of our trustees for expenses incurred in connection with attending board of trustees and committee meetings. In addition, if the board of trustees forms a special committee, the trustees serving on the special committee may receive additional compensation.

The table below summarizes the compensation received by our independent trustees during 2023.

| | | | | | | | | | | | | | | | | | | | |

Trustee Compensation Table for 2023 |

Name(1) | | Fees Paid or Earned in Cash(2) | | Stock Awards(2) | | Total |

| Paul W. Hylbert, Jr. | | $ | 105,000 | | | $ | 100,000 | | | $ | 205,000 | |

| Chad L. Meisinger | | 70,000 | | | 100,000 | | | 170,000 | |

| Steven G. Osgood | | 90,000 | | | 100,000 | | | 190,000 | |

| Dominic M. Palazzo | | 85,000 | | | 100,000 | | | 185,000 | |

| Rebecca L. Steinfort | | 85,000 | | | 100,000 | | | 185,000 | |

Mark Van Mourick(3) | | 61,250 | | | 100,000 | | | 161,250 | |

| Charles F. Wu | | 70,000 | | | 100,000 | | | 170,000 | |

| Total | | $ | 566,250 | | | $ | 700,000 | | | $ | 1,266,250 | |

(1) George L. Chapman was a member of our board of trustees in 2023 until he unexpectedly passed away on March 22, 2023. J. Timothy Warren was a member of our board of trustees in 2023 until May 22, 2023, the date of our 2023 annual meeting of shareholders. Neither Mr. Chapman nor Mr. Warren received any compensation in 2023 in connection with their board service and therefore are not included in the above table. Ms. Cohn is not included in the above table because she was elected to the Board in February 2024 and did not receive any compensation for the year ended December 31, 2023. Mr. Schall is not included in the above table because he is a trustee nominee standing for election at the Annual Meeting.

(2) For those trustees that elected in 2023 to receive any portion of the value of their 2023 annual cash compensation in equity, grants for the full value of such compensation were made on May 26, 2023, based on the closing price of our Common Shares on May 24, 2023 of $36.60. Each of Messrs. Hylbert, Meisinger, Osgood, Palazzo, and Wu and Ms. Steinfort elected to receive payment of 100%, and Mr. Van Mourick elected to receive payment of 50%, of the value of his or her 2023 annual cash compensation in LTIP units which represent a class of partnership interests in our operating partnership. Accordingly, Messrs. Hylbert, Meisinger, Osgood, Palazzo, Van Mourick, and Wu and Ms. Steinfort were awarded LTIP units as follows: Mr. Hylbert - 5,602 units, Mr. Meisinger - 4,645 units, Mr. Osgood - 5,192 units, Mr. Palazzo - 5,055 units, Ms. Steinfort - 5,055 units, Mr. Van Mourick - 3,689 units, and Mr. Wu - 4,645 units. The dollar values shown in the table above for the LTIP units, including LTIP units taken in lieu of cash compensation, represent the aggregate grant date fair value computed in accordance with Financial Accounting Standards Board Accounting Standards Codification ("ASC") Topic 718. The LTIP units granted on May 26, 2023 are scheduled to vest on the earlier of May 23, 2024 and the calendar day immediately preceding our 2024 Annual Meeting, so long as such person remains a trustee. With respect to the portion of Mr. Van Mourick's 2023 annual cash compensation taken in cash, Mr. Van Mourick was paid three-fourths of such amount ($26,250) between April 1, 2023 and December 31, 2023, which is reflected in the above table. The remaining installment of Mr. Van Mourick's 2023 cash compensation ($8,750) was paid in 2024 and is not reflected in the above table. The 1,262 LTIP units granted to Mr. Wu on February 25, 2021 in connection with his election to the board of trustees vested on February 25, 2023. The following table sets forth the aggregate number of outstanding compensatory LTIP units held by our non-employee trustees that had not vested as of December 31, 2023:

| | | | | | | | |

Name | | Number of LTIP units |

| Paul W. Hylbert, Jr. | | 5,602 | |

| Chad L. Meisinger | | 4,645 | |

| Steven G. Osgood | | 5,192 | |

| Dominic M. Palazzo | | 5,055 | |

| Rebecca L. Steinfort | | 5,055 | |

| Mark Van Mourick | | 3,689 | |

| Charles F. Wu | | 4,645 | |

(3) Excludes consideration paid to entities controlled or managed by Mr. Van Mourick, or in which he has an ownership interest, in connection with the acquisition by us of self storage properties or the management of our properties by entities in which Mr. Van Mourick has an interest. For additional information see "Certain Relationships and Related Transactions–Material Benefits to Related Parties."

Each independent trustee is subject to our minimum equity ownership guidelines. See "Our Pay–Compensation Discussion and Analysis–How We Oversee and Apply our Pay Programs–Minimum Equity Ownership Guidelines."

| | | | | |

NATIONAL STORAGE AFFILIATES 2024 PROXY STATEMENT | 26 |

PROPOSAL 2 FOR AUDITOR VOTE

PROPOSAL 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has appointed KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024. Our board of trustees is requesting that our shareholders ratify this appointment of KPMG LLP.

KPMG LLP has audited our consolidated financial statements since the Company's formation. KPMG LLP has also provided certain other services to us.

Neither our Bylaws nor other governing documents or law require shareholder ratification of the Audit Committee's appointment of KPMG LLP as our independent registered public accounting firm. However, our board of trustees is submitting the appointment of KPMG LLP to the shareholders for ratification as a matter of good corporate practice. If the ratification of this appointment is not approved at the Annual Meeting, the Audit Committee will review its future selection of our independent registered public accounting firm. Even if the selection is ratified, the Audit Committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the year if it determines that such a change would be in our best interests.